When Must Companies Provide 1099

Independent contractors freelancers and sole proprietors should receive their 1099-NEC forms from their payers by Feb. If you are required to file 1099s then forms must be sent to the recipient by January 31st.

E File 1099 And W 2 Tax Forms Online With Efile4biz Com Filing Taxes Business Tax Tax Forms

E File 1099 And W 2 Tax Forms Online With Efile4biz Com Filing Taxes Business Tax Tax Forms

You dont need to issue 1099s for payment made for personal purposes.

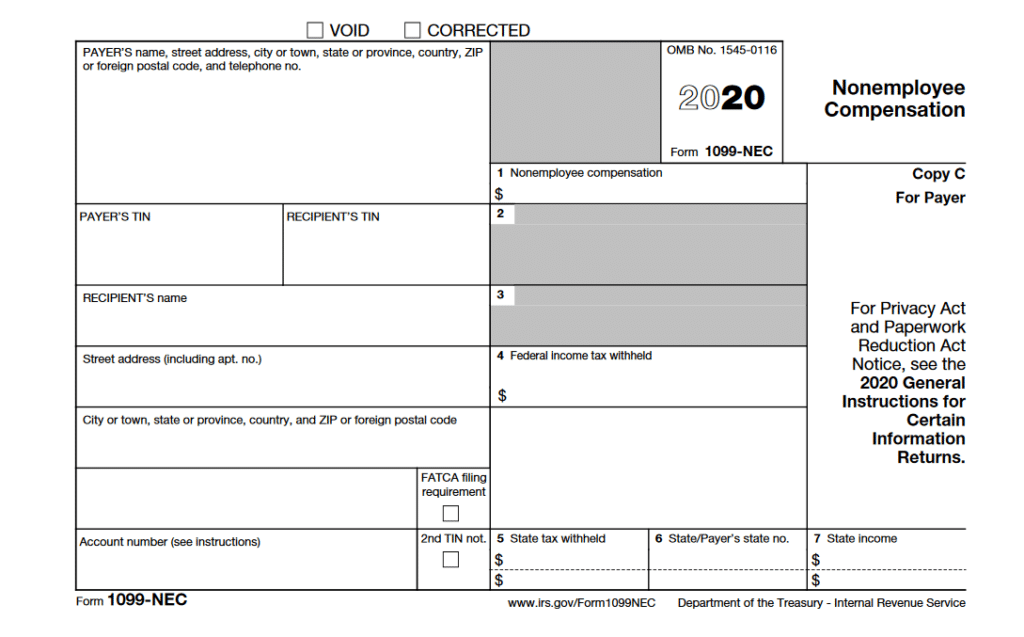

When must companies provide 1099. If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. Often referred to as an independent contractor or consultant a 1099 employee is self-employed. As such when an employer enters into a contract with a 1099 employee this individual remains responsible for their own hours tools taxes and benefits.

The forms must also be sent to the IRS by February 28th if you file the 1099s by mail or by March 31st if you file electronically. If you close a transaction with a title company or attorney as most people do they will collect the necessary information and file Form 1099-S for you. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis.

When an LLC Must Provide Form 1099-MISC. You may begin to receive these documents as. The general rule is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least 600 in rents services including parts and materials prizes and awards or other income payments.

You pay an individual at least 600 over the course of a year provided this payment or payments was for a prize rent or service including materials or parts. 1 of the year following the tax year. February 28 of the year after the tax year is the due date for 1099-MISC forms for both payees and the IRS however the due date changes each year for holidays and weekends.

If the following four conditions are met you must generally report a payment as nonemployee compensation. Independent contractors use a 1099 form and employees use a W-2. By January 31 banks brokers and mutual fund companies are supposed to provide investors the Form 1099 information reports they need to.

Most states use the same filing deadline. The deadline for distributing 1099s to vendors is February 1st. All 1099-MISC forms reporting payments to independent contractors must be filed with the IRS by January 31.

The same date applies to. The same deadline applies for completing and providing the 1099-NEC. If you use paper 1099s you must then file another information return Form 1096 to transmit the 1099 information to the IRS by February 28th.

A lawsuit settlement that you have paid out also requires you to issue a 1099-MISC. For example you should have received your forms by Feb. For example because February 28 falls on a Sunday in 2021 the due date for 2020 forms is March 1 2021.

Both W-3 and 1096 summation forms are also due to the appropriate government agency by February 1 2021. In general you have to issue a 1099-MISC tax form whenever. Both the LLC and the independent contractor are responsible for the form.

If you use an authorized provider of electronic 1099 transmission no form 1096 is required and the due date for eFiling is March 31st. The business must provide the independent contractor with Form 1099-MISC. For the 2020 tax year employers must provide employees with a Form W-2 by February 1 2021.

Typically youll receive a 1099 because you earned some form of income from a non-employer source. The business uses it to prove expenses and the contractor uses it to report the income and pay any necessary taxes on that income. If the seller certifies that the sale price is for 250K or less and the sale is for their principal residence the transaction is not reportable.

For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. The independent contractor must also be provided a copy no later than January 31. You made the payment to someone who is not your employee.

When Form 1099-MISC Must Be Filed The basic rule is that you must file a 1099-MISC whenever you pay an unincorporated independent contractor-that is an independent contractor who is a sole proprietor or member of a partnership or LLC-600 or more in a year for work done in the course of your trade or business by direct deposit or cash. When and Where Do I File 1099-MISC Forms. January 31st is right around the corner so.

1 2021 for the 2020 tax year. This is so whether they are filed electronically or on paper.

You Do Not Require To Provide A 1099 Return For Corporations Payments For Merchandise Telephone Freight Storage Payments To Real Estate B Irs Forms Form Irs

You Do Not Require To Provide A 1099 Return For Corporations Payments For Merchandise Telephone Freight Storage Payments To Real Estate B Irs Forms Form Irs

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Irs Approved 1098 E Tax Forms File This Form If You Receive Student Loan Interest Of 600 Or More From An Individual During The Y Tax Forms 1099 Tax Form Form

Irs Approved 1098 E Tax Forms File This Form If You Receive Student Loan Interest Of 600 Or More From An Individual During The Y Tax Forms 1099 Tax Form Form

Rhode Island Aca Reporting Deadline Rhode Island Island Employment

Rhode Island Aca Reporting Deadline Rhode Island Island Employment

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number

How Does An Irs 1099 Misc Different From A W 9 When Filing Taxes Filing Taxes Irs Forms Employer Identification Number