How To Read An Llc Tax Return

Single-member LLCs can be taxed as corporations or sole proprietorships and multi-member LLCs can choose to be taxed like corporations or partnerships. And Line 34 reports the total tax due.

What Is Form 1120s And How Do I File It Ask Gusto

What Is Form 1120s And How Do I File It Ask Gusto

If you filed a return last year retrieve those documents.

How to read an llc tax return. Prepare and file your tax return and supporting documentation. However a drawback to corporate treatment is that business earnings are taxed twice. Look at it this way.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and. Also known as Form 1120 LLC owners use the corporate tax return to report the corporations income gains losses deductions credits and to calculate its tax. When in doubt file an LLC return.

Here are the necessary tax returns to file for each LLC type and tax status. A Limited Liability Company LLC is an entity created by state statute. Use Your Employer ID Number EIN for LLC Tax Filing.

Your form of business determines which income tax return form you have to file. If an LLC has two or more members the IRS automatically treats it as a partnership. You receive a Schedule K-1 is prepared for each partner showing your share of the profit or loss of the partnership.

The most common forms of business are the sole proprietorship partnership corporation and S corporation. The LLCs member reports the LLCs income and expenses on his or her personal tax return. The date you get your tax refund also depends on how you filed your return.

An LLC that does not want to accept its default federal tax classification or that wishes to change its classification uses Form 8832 Entity Classification Election PDF to elect how it will be classified for federal tax purposes. For example lets say an. Then your LLC must.

A Limited Liability Company LLC is a business structure allowed by state statute. To prepare your LLC tax return you should follow these steps. - Line 42 subtracts the exemptions from line 6 multiplied by 4050.

When beginning a business you must decide what form of business entity to establish. If you are the only one who owns the LLC you are required to pay tax on your profits the way a sole proprietor would. However an LLC can change these default classifications and choose to.

Turning the page you start with your AGI and then subtract the following to figure exactly how much tax you owe. If your LLC only has one member it is treated as a disregarded entity for tax purposes unless you elected otherwise. Pay the 800 annual tax By the 15th day of the 4th month after the beginning of the current tax year.

Preparing an LLC Tax Return. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. Line 31 reports the amount of total tax the corporation is responsible for.

Use Limited Liability Company Tax Voucher FTB 3522 Estimate and pay the LLC fee By the 15th day of the 6th month after the beginning of the current tax. Single-member LLCs may NOT file a partnership return. For example with refunds going into your bank account via direct deposit it could take an additional five days for.

The LLC files an informational partnership tax return and the members also report the LLCs income and expenses on their personal tax returns. The LLC tax return could refer to a variety of tax forms that have to be filed to the IRS when operating this legal entity. You must ransfer Schedule K-1 information to Schedule E - Supplemental income.

Determine your tax election. - On line 40 you subtract the larger of the standard deduction or the expenses you itemized on Schedule A more on that in our next blog. Your LLC tax return needs to be filed with your businesss tax ID number also known as your Employer ID Number EIN not your Social Security number.

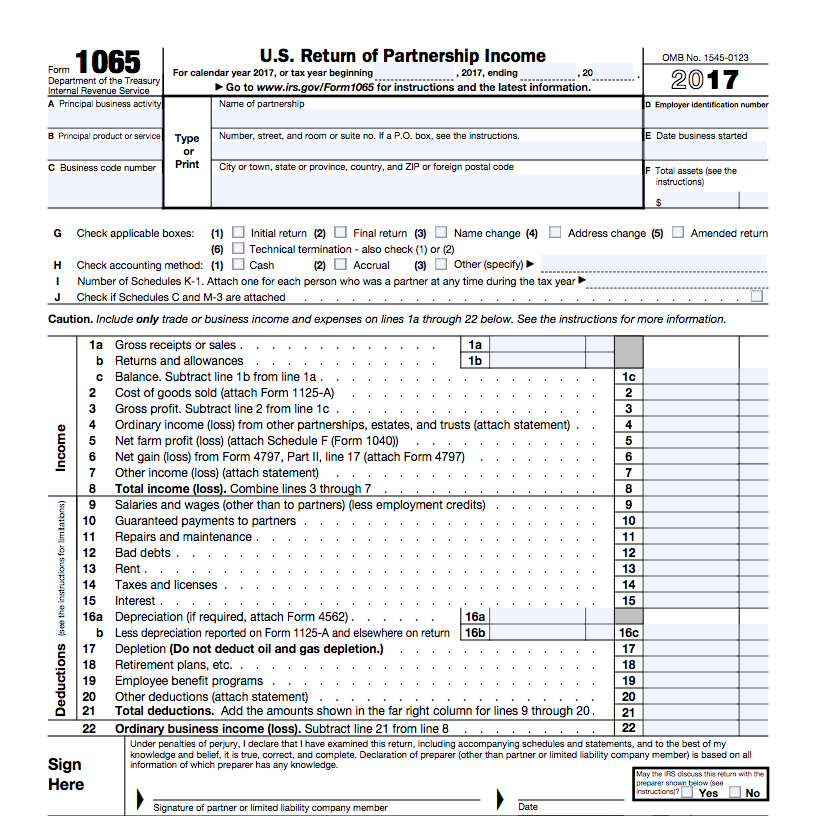

Though the standard multi-owner LLC pays tax through its owners the LLC files Form 1065 an information return that details earnings. Upon officially forming an LLC your business entity could be considered a partnership by the IRS for income tax only. Tax software can walk you through filing your inactive LLC tax return.

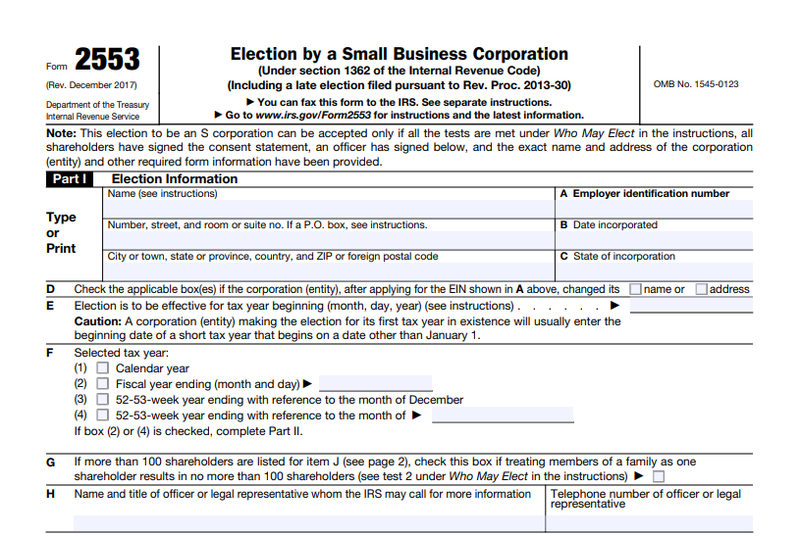

If there was an overpayment of estimated taxes Line 35 reports the amount of the overpayment. Generally an election specifying an LLCs classification cannot take effect more than 75 days prior to the date the election is filed nor can it take effect later than 12. Getting taxed as a C corporation means that instead of letting the LLCs income and expenses flow through to their personal tax returns the LLC owners will now get taxed separately from the company and the LLC will have to file its own separate corporate tax return.

If the only member of the LLC is an individual the LLC income and expenses are reported on Form 1040 Schedule C E or F. Line 32 reports total tax payments made throughout the year. Dont make the mistake of confusing your business and personal tax returns.

The IRS cant penalize you for filing a return for your inactive. Multi-member LLCs taxed as a partnership file the total businesss income on Form 1065 and each partner reports their individual profits on Schedule K-1 as well as their personal tax return. If the LLC fails to pay the tax or file a return you and the other owners are not personally liable.

Your Social Security number is a personal individual tax ID number that cannot be used for a businesss. The tax return forms an LLC must file vary by tax classification. If the only member of the LLC is a corporation the LLC income and expenses are reported on the corporations return usually Form 1120 or Form 1120S.

The partnership files an information return with the IRS on Form 1065. LLCs that choose to be taxed as a C corp file Form 1120 and the owners do NOT report business income on their personal tax return. The first level of tax occurs when the LLC files a corporate tax return and the second is imposed on the owners when they receive a dividend.

Does My Llc Need To File A Tax Return Even If It Had No Activity Small Business Tax Business Tax Llc Business

Does My Llc Need To File A Tax Return Even If It Had No Activity Small Business Tax Business Tax Llc Business

Does My Llc Need To File A Tax Return Even If It Had No Activity In 2020 Filing Taxes Tax Return Llc Taxes

Does My Llc Need To File A Tax Return Even If It Had No Activity In 2020 Filing Taxes Tax Return Llc Taxes

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Llc Business Tax Return

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Llc Business Tax Return

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

To Win At The Tax Game Know The Rules Published 2015 Tax Forms Irs Tax Forms Irs Taxes

S Corp Vs Llc Everything You Need To Know The Blueprint

S Corp Vs Llc Everything You Need To Know The Blueprint

How To File Your Llc Tax Return The Tech Savvy Cpa Llc Taxes Business Tax Llc Business

How To File Your Llc Tax Return The Tech Savvy Cpa Llc Taxes Business Tax Llc Business

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

How To Start An Llc Online Quickly And Easily Tax Queen Small Business Tax Tax Deductions List Business Bank Account

How To Start An Llc Online Quickly And Easily Tax Queen Small Business Tax Tax Deductions List Business Bank Account

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Form 1065 Instructions Information For Partnership Tax Returns

Form 1065 Instructions Information For Partnership Tax Returns

Irs Tax Filing Rules For Ebay Sales Sapling Business Tax Llc Business Self Employment

Irs Tax Filing Rules For Ebay Sales Sapling Business Tax Llc Business Self Employment

Standard Vs Itemized Deductions For All The Visual Learners Out There This Board Is For You We Ve Condensed Co Filing Taxes Tax Guide Tax Deductions List

Standard Vs Itemized Deductions For All The Visual Learners Out There This Board Is For You We Ve Condensed Co Filing Taxes Tax Guide Tax Deductions List

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Tax Return Small Business Tax

Does My Llc Need To File A Tax Return Even If It Had No Activity Filing Taxes Tax Return Small Business Tax

S Corp Vs Llc Everything You Need To Know The Blueprint

S Corp Vs Llc Everything You Need To Know The Blueprint

Fairytaxmother Com Nbspfairytaxmother Resources And Information Business Tax Llc Taxes Tax Help

Fairytaxmother Com Nbspfairytaxmother Resources And Information Business Tax Llc Taxes Tax Help

Does My Llc Need To File A Tax Return Even If It Had No Activity In 2020 Tax Return Filing Taxes Tax Deductions List

Does My Llc Need To File A Tax Return Even If It Had No Activity In 2020 Tax Return Filing Taxes Tax Deductions List

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely