Which Form Of Business Organization Is Established As A Legal Entity Separate From Its Owners

Limited liability is a benefit to both corporations and partnerships but not to sole proprietorships. It is a legal entity that provides limited liability to its owners and is organized under state laws.

C Corporation Bookkeeping Business Business Notes C Corporation

C Corporation Bookkeeping Business Business Notes C Corporation

However firms do not require to turn a gain to certainly be a business.

Which form of business organization is established as a legal entity separate from its owners. There is no separate tax on the earnings of the companies if they choose to be treated as a partnership. Sole Proprietorship and Partnership. A corporation is a legal entity created by the state whose assets and liabilities are separate from its owners.

The term double taxation refers to which of the following. Which form of business organization is established as a legal entity separate from its owners. Which form of business organization is established as a separate legal entity from its owners.

A sole prop on its net in required to B. A sole proprietorship is the simplest form of business where an. Mültiple Choice Sole proprietorship Corporation Partnership None of these COMPANY.

Banks insurance companies and nonprofit organizations are the most common forms of LLCs. Which form of business organization is established as a legal entity separate from its owners. A sole proprietorship is an accounting entity separate from its owners.

Limited Liability of shareholders The business is viewed as a separate legal entity. Which form of business organization is established as a legal entity separate from its owners. Which form of business organization is established as a separate legal entity from its owners.

Sole proprietors hip B. Articles of incorporation are legal documents filed with basic information about the. Organization generally refers to businesses that find gains by providing goods or solutions in exchange for payment.

Which form of business organization is established as a separate legal entity from its owners. None of these Corporations are owned by shareholders. Ability to raise large amount of capital Public limited companies are able to raise large sums of money because there is no limit on the maximum number of members.

Corporations file and pay income taxes on their own. A limited liability company LLC is a flexible entity structure that can combine the concepts of sole proprietorships if there is one owner partnerships and or corporate structures. See full answer below.

The answer is - Corporation A corporation is a form of a business organization established as a legal entity separate from its owners by the. Corporations generate the largest income and the most sales. Which form of business organization is established as a legal entity separate from its owners.

Become a member and unlock all. Which Form Of Business Organization Is Established As A Legal Entity Separate From Its Owners. C corporation is a separate legal entity that in the eyes of the law is separate from its owners.

Sole proprietorship Corporation Partnership None of these. This means that even if a shareholder leaves the PLC or dies the business can continue.

Business Ownership Structure Types Business Structure Business Basics Business Ownership

Business Ownership Structure Types Business Structure Business Basics Business Ownership

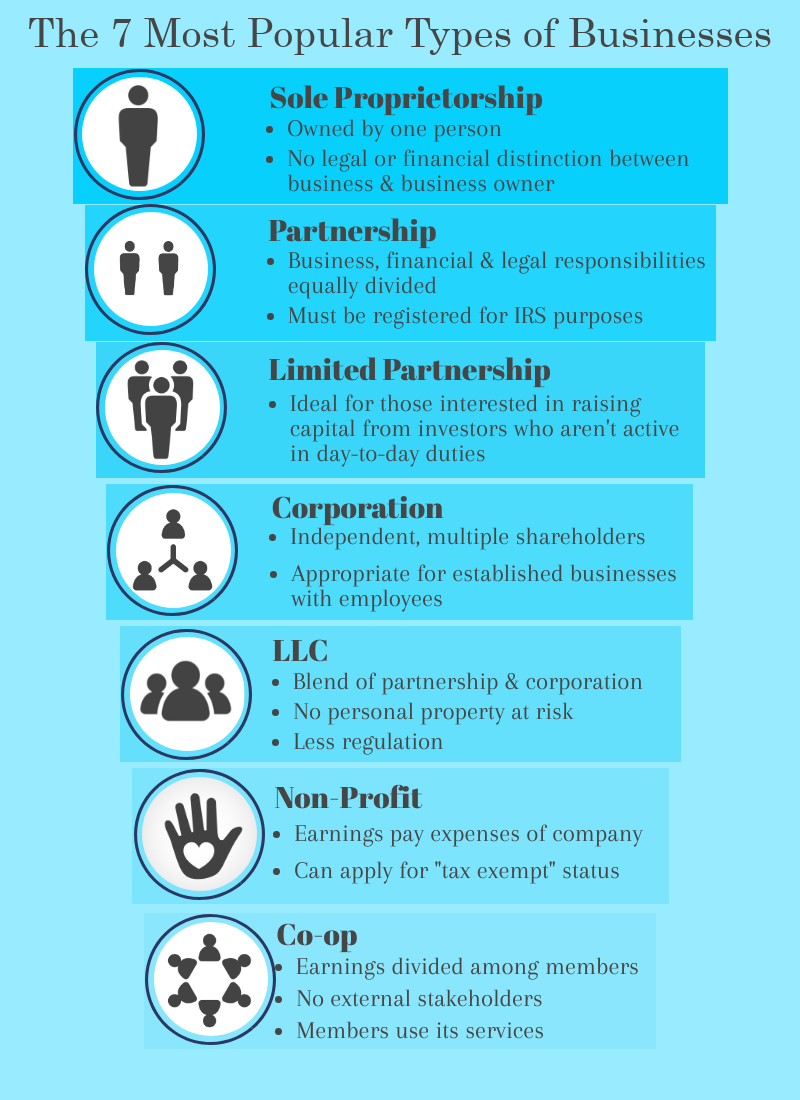

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

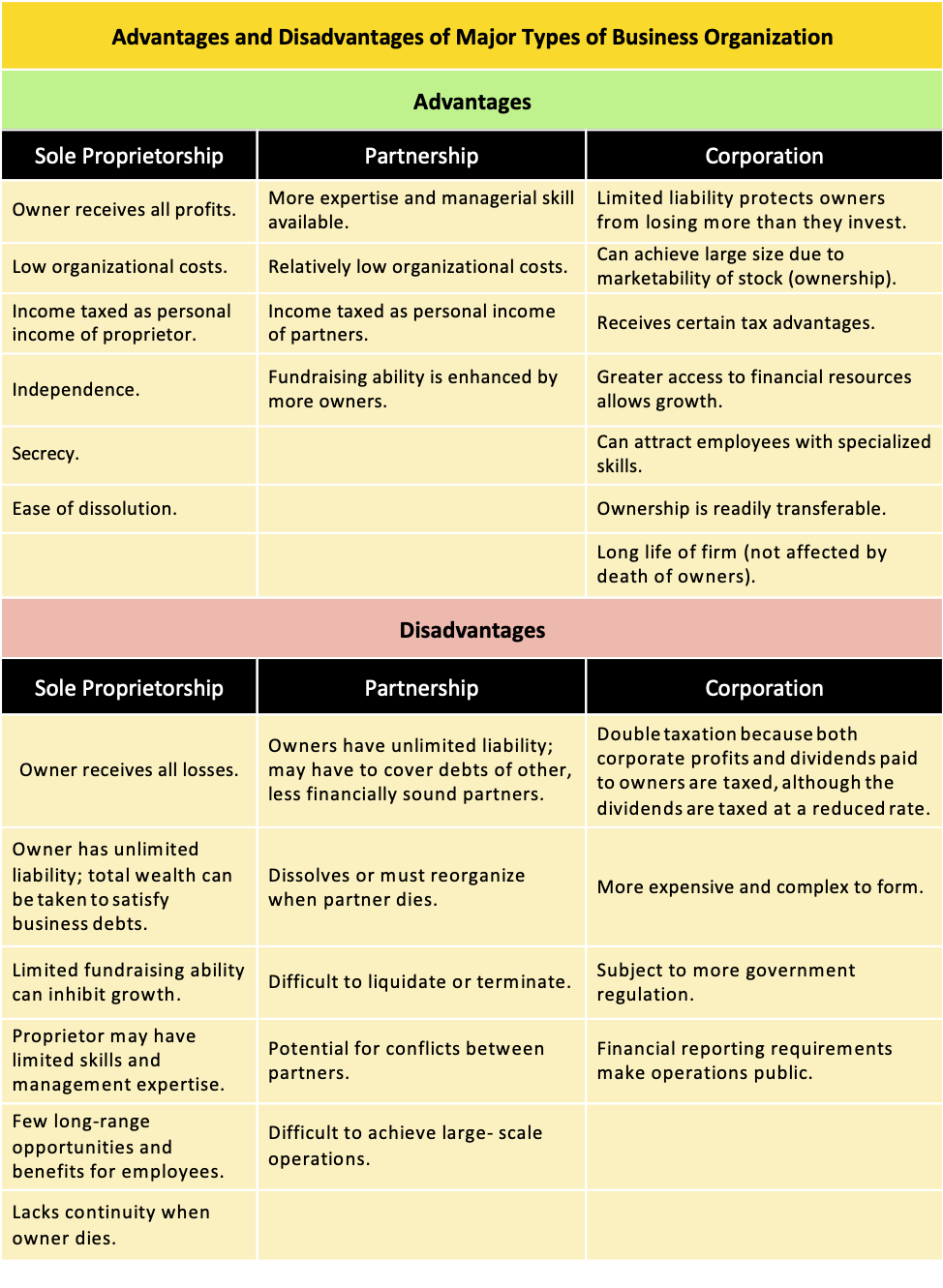

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

The Types Of Business Ownership Startup Business Plan Bookkeeping Business Business Ownership

Business Structure Overview Forms How They Work

Business Structure Overview Forms How They Work

Legal Forms Of Business Organization

Legal Forms Of Business Organization

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

Apply For Your Limited Liability Partnership Company Legal Business Organization Business

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Benefits Of Incorporating Business Law Small Business Deductions Business

Benefits Of Incorporating Business Law Small Business Deductions Business

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Choosing Ownership Structure For Your Startup Business Format Business Structure Management Infographic

Choosing Ownership Structure For Your Startup Business Format Business Structure Management Infographic

Chapter 4 Forms Of Business Ownership Introduction To Business

Chapter 4 Forms Of Business Ownership Introduction To Business

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

Corporate Entity Types Table Bookkeeping Business C Corporation S Corporation

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation

C Corporation Formation Services Ez Incorporate C Corporation Corporate Legal Separation