Is A 1099-nec Self Employed

Previously companies reported this income information on Form 1099-MISC Box 7. To exempt your 1099-NEC from self-employment tax.

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

1099 Misc Or 1099 Nec What You Need To Know About The New Irs Requirements Northeast Financial Strategies Inc

You may as well file the schedule C with your tax return and pay the self-employment tax.

Is a 1099-nec self employed. Beginning with tax year 2020 the IRS will require your self-employment income of 600 or more to be reported on Form 1099-NEC non-employee compensation instead of Form 1099-MISC so look out for that form in the. Use Form 1099-NEC to report nonemployee compensation. Type 1099-NEC is Search in the upper right.

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. This is true even if you dont file a Schedule C. Report Self-Employment Earnings With 1099 NEC Form 2020.

You made the payment to someone who is not your employee. The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax. It is equivalent to both halves of the employer and employee payroll taxes that apply to.

If you are self-employed a freelancer contractor or work a side gig you may be used to receiving Form 1099-MISC that reports your self-employed income at tax time. If the amount for services of non-employee listed in box 1 of 1099 NEC Form then the organization treats you as a self-employed worker. Fellowship recipients are neither employees nor self-employed with respect to.

1 for 2020 or make it. Click Jump to 1099-nec. Claim the income as business income and write off any and all expenses associated with the job.

Payments to individuals that are not reportable on the 1099-NEC form would typically be reported on Form 1099-MISC. You may simply perform services as a non-employee. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor.

However it does clearly indicate that you are not an employee of your university. Yes if you have 1099 income you are considered to be self-employed and you will need to pay self-employment taxes Social Security and Medicare taxes on this income. Having 1099-MISC Box 3 income does not mean that you are self-employed the way that Box 7 income would.

Now use Form 1099-NEC and if you receive one remember that self-employment tax can be expensive. Examples of this include freelance work or driving for DoorDash or Uber. Businesses should send or postmark Form 1099-NEC to any self-employed person that worked during the last tax year by Feb.

The 1099-NEC is the new form to report nonemployee compensationthat is pay from independent contractor jobs also sometimes referred to as self-employment income. Fill in why you received the 1099-NEC in Describe the reason for this 1099-NEC. In order to claim tax withheld on 1099-NEC income the IRS and most states require Lacerte to recreate a digital copy of the Form 1099-NEC your client received and include it in the e-filed return.

Say Yes to Did you get a 1099-NEC. If the following four conditions are met you must generally report a payment as nonemployee compensation. The program uses your input in Form 1099-MISCNEC for E-File Returns to meet this agency requirement AND to report withholding amounts on the.

Social Security taxable wages are capped at a maximum each year. Select Add a 1099-NEC on Do You Want to Enter Your 1099-NECs Now. Also the self-employed worker referred to as an independent contractor.

Most people who receive a 1099MISC for non-employee compensation are going to be considered self-employed by IRS standards. Current Revision Form 1099-NEC PDF Information about Form 1099-NEC Nonemployee Compensation including recent updates related forms and instructions on how to file. The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business.

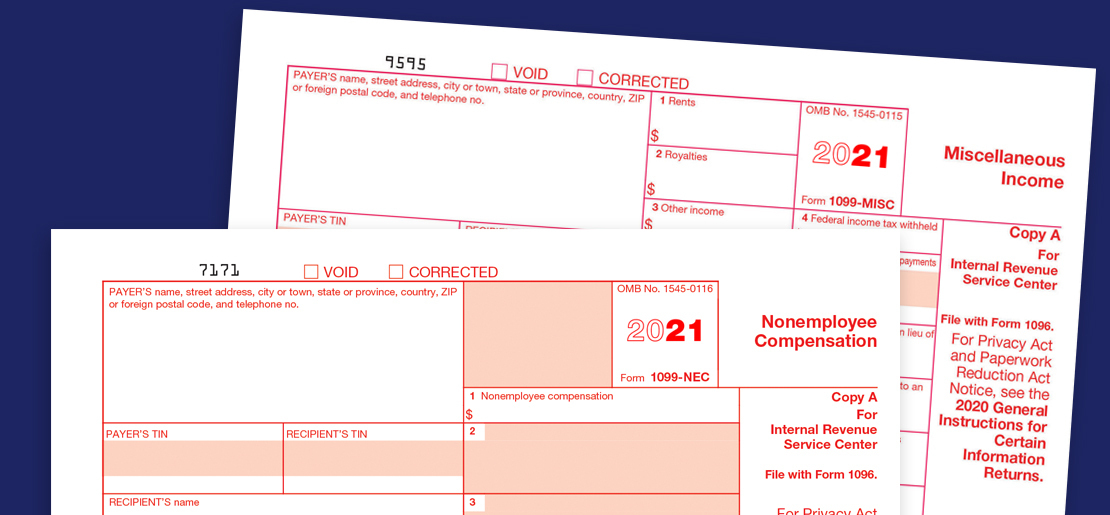

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Form 1099 Misc Vs Form 1099 Nec How Are They Different

What Is The 1099 Nec Form The Irs Has Now Split Independent Contractor Payments Over Two Forms We Provide An Overvi Small Business Tax Business Tax Tax Forms

What Is The 1099 Nec Form The Irs Has Now Split Independent Contractor Payments Over Two Forms We Provide An Overvi Small Business Tax Business Tax Tax Forms

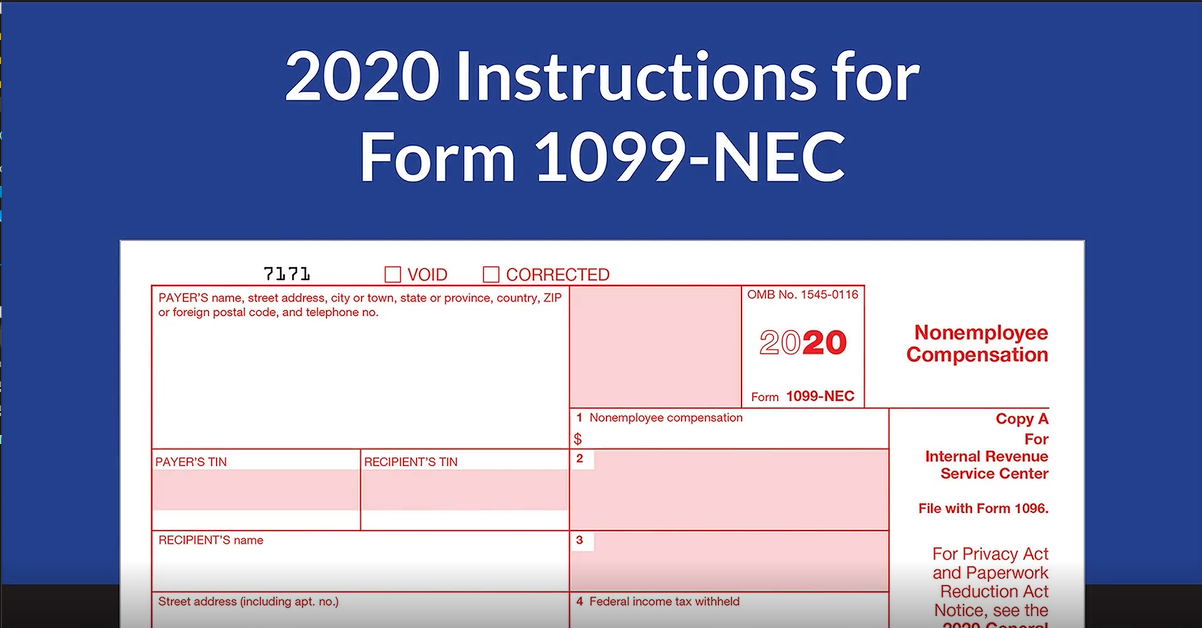

Freelancers Meet The New Form 1099 Nec

Freelancers Meet The New Form 1099 Nec

Pin By Jr Tax On Taxation In 2021 Tax Return

Pin By Jr Tax On Taxation In 2021 Tax Return

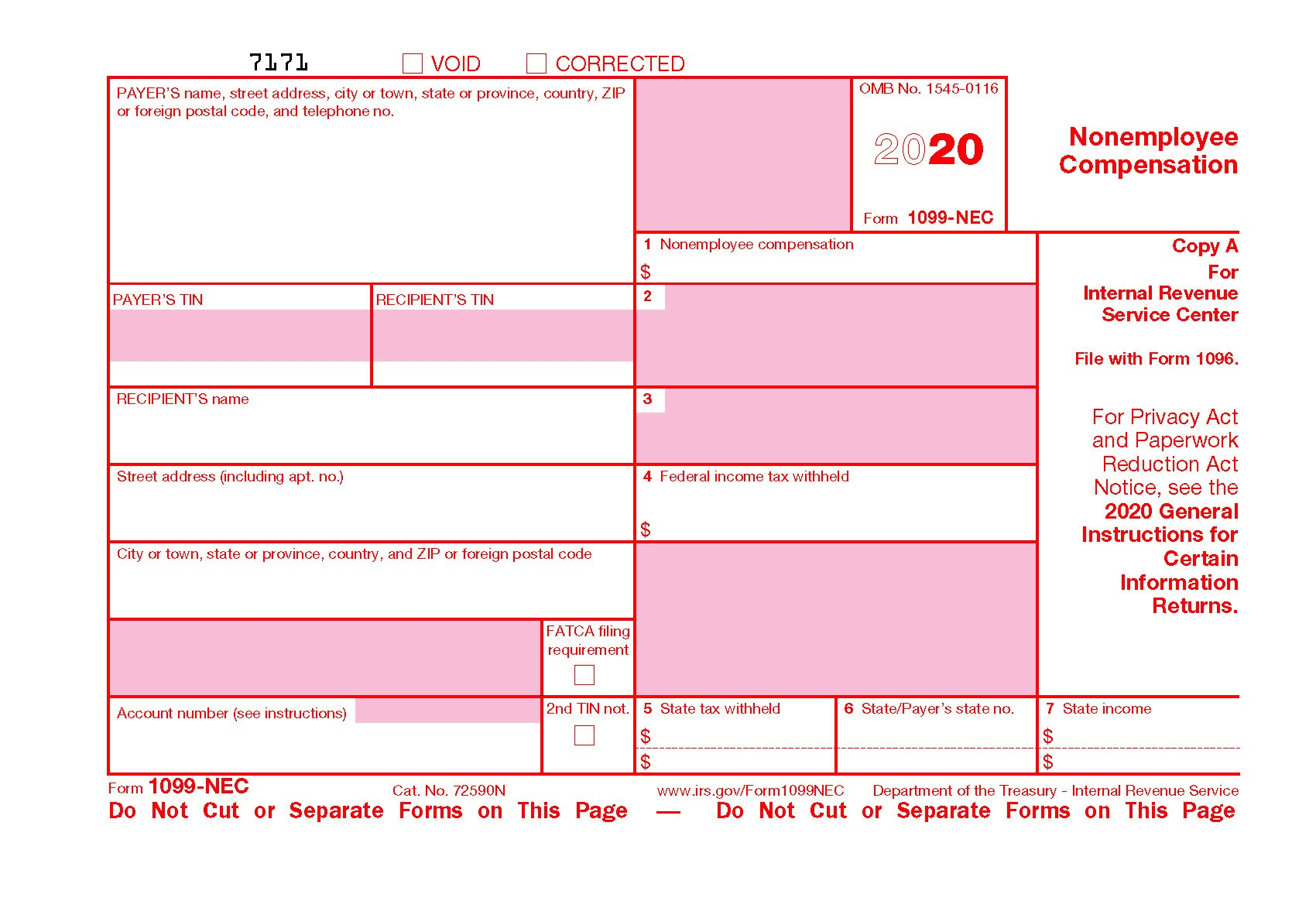

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

New 1099 Nec Form For Independent Contractors The Dancing Accountant

New 1099 Nec Form For Independent Contractors The Dancing Accountant

1099 Nec Free 1099 Tax Form 1099 Nec Reporting Tax Forms 1099 Tax Form Irs Forms

1099 Nec Free 1099 Tax Form 1099 Nec Reporting Tax Forms 1099 Tax Form Irs Forms

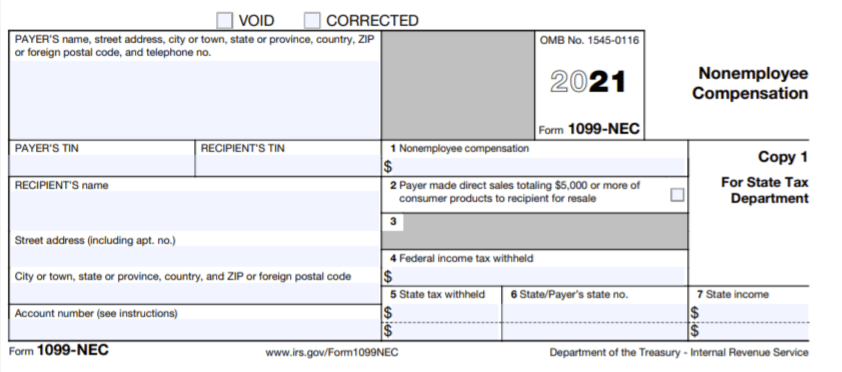

What Is Form 1099 Nec For Nonemployee Compensation

What Is Form 1099 Nec For Nonemployee Compensation

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

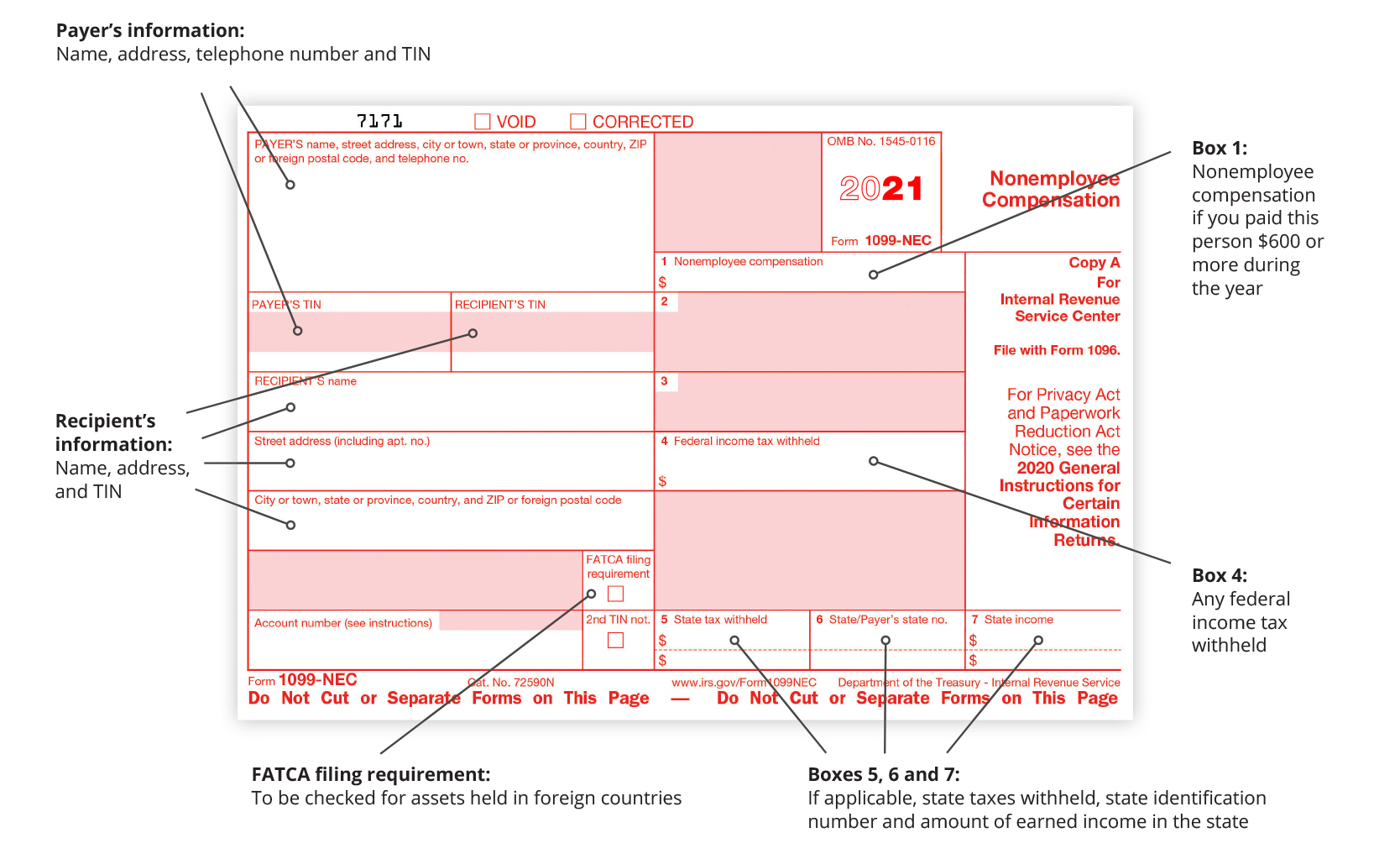

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To File Taxes With Irs Form 1099 Misc Turbotax Tax Tips Videos Filing Taxes Irs Forms Irs Taxes

How To File Taxes With Irs Form 1099 Misc Turbotax Tax Tips Videos Filing Taxes Irs Forms Irs Taxes

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Delayed Payment Of Particular Payroll Taxes And Self Employment Taxes Payroll Taxes Efile Self Employment

Delayed Payment Of Particular Payroll Taxes And Self Employment Taxes Payroll Taxes Efile Self Employment

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

Efile Form 1099 Nec Online 2020 Online Efile Irs Forms

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec