How To Make A 1099 For An Employee

The most important distinction to make is whether people work in an independent contractor capacity or if they work in a common law employeremployee capacity. This will often give you the option to hire top-notch talent without the obligation to retain them long-term.

Instant Form 1099 Generator Create 1099 Easily Form Pros

Instant Form 1099 Generator Create 1099 Easily Form Pros

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made.

How to make a 1099 for an employee. Keep scrolling our blog for more. The only difference is that youll need to emphasize the parameters of the employment relationship during each step of the hiring process starting with the job description. Employing an independent contractor allows for simpler administration.

The amount of income paid to you during the year in the appropriate box based on the type of income you received 4. As with any job when youre looking to hire a 1099 employee youll want to craft a well-worded job description ask relevant interview questions and check references. How to file Schedule C for 1099-MISC.

Benefits of Using a 1099 Employee. Need more career advice. However the benefits to employers are often extensive and worth taking notice of.

If you pay them 600 or more over the course of a year you will need to file a 1099-MISC with the IRS and send a copy to your contractor. How to Hire a 1099 Employee. Proof of income is an important element of any major adult transaction.

As such when an employer enters into a contract with a 1099 employee this individual remains responsible for their own hours tools taxes and benefits. Before you start the 1099 process make sure you have all the correct information on your. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC.

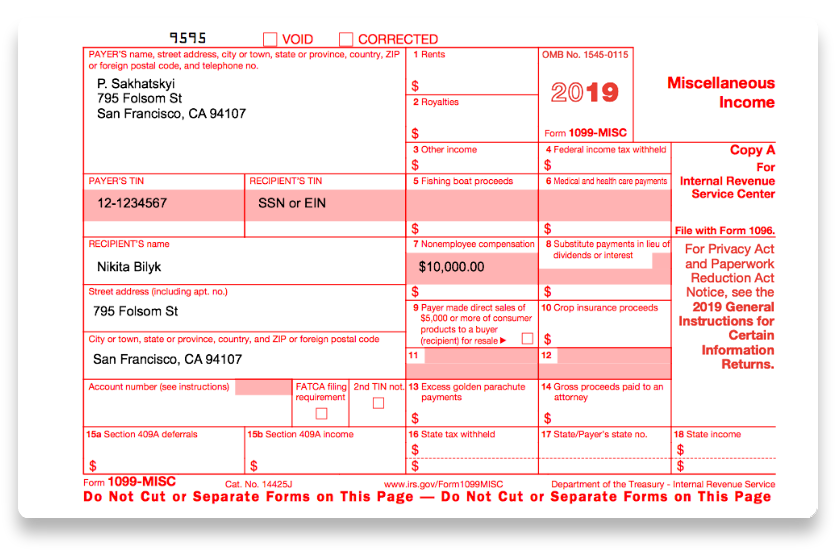

Youre in a self-employed trade or business if your primary purpose is to make a profit and your activity is regular and continuous. The 1099-MISC Form generally includes. The payer has determined that an employer-employee relationship doesnt exist in your case.

So how do I prepare the 1099s. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. Unlike a standard full- or part-time employee W2 employee 1099 employees are required to follow different laws and regulations and.

If you sold physical products subtract your returns and cost of good sold to get your gross income. By hiring a 1099 employee your company has the flexibility to bring on specific people for specific projects. If you werent an employee of the payer where you report the income depends on whether your activity is a trade or business.

1099 employees can obtain a number of important benefits from this working relationship including the ability to work on a more flexible basis change work environments on a routine basis run their own business and have greater freedom. The name address and taxpayer ID number of the company or individual who issued the form 3. Heres a brief rundown of how to fill out Schedule C.

You can also buy 1099-MISC forms at your local office supply store although most only come in batches of 25 or 50. If youre using a 1099 employee you will first want to create a written contract. You cannot use a.

You pay an employee with a paycheck they receive a W2. Employee are not 1099. Your name address and taxpayer ID number 2.

Calculate your gross income by adding up all the income from your 1099 forms and any employer who paid you less than 600. Fill out the forms. The above instructions on creating a 1099 pay stub can help immensely.

Often referred to as an independent contractor or consultant a 1099 employee is self-employed. Theres less initial paperwork to. Once you have accurate information to work with its time to get your 1099s.

Obtain a 1099-MISC form from the IRS or another reputable source. You can ask the IRS to send you the necessary form by calling 1-800-TAX-FORM 1-800-829-3676 or navigating to their online ordering page. If you need help with employee classification or filing the appropriate paperwork post your need in UpCounsels marketplace.

Creating a 1099 Pay Stub. If youre a self-employed individual youll need to find a way to create this proof. This article will dive into the differences and what criteria is most important to look at when making a decision on how to classify your workers.

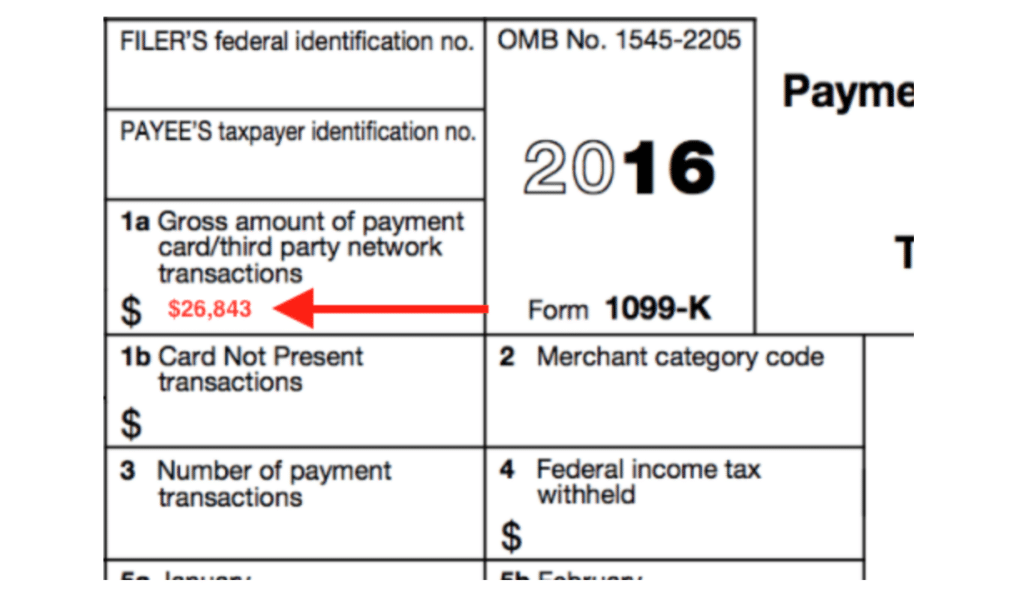

Payers use Form 1099-MISC Miscellaneous Income or Form 1099-NEC Nonemployee Compensation to. A vendor is someone you pay the receive a 1099.

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Before You 1099 Make Sure You W 9 Cpa Practice Advisor

Before You 1099 Make Sure You W 9 Cpa Practice Advisor

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

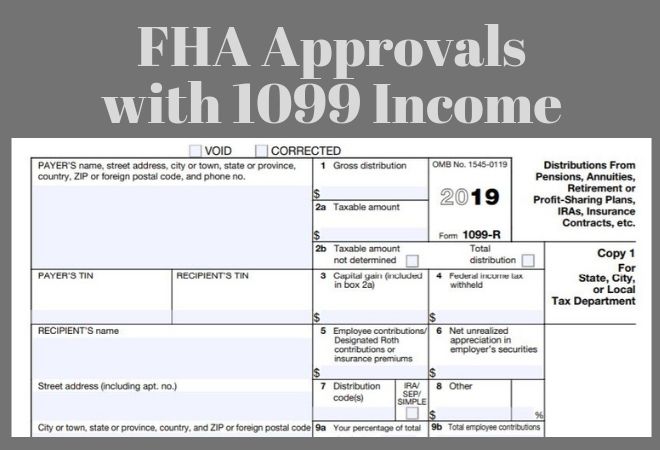

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Freelancers Meet The New Form 1099 Nec

Freelancers Meet The New Form 1099 Nec

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager