How To Deduct Unreimbursed Business Expenses In 2020

The Notice describes the TCDTRAs temporary. Jan 31 2020 If you are a sole proprietor and complete the Schedule C then you may generally deduct your ordinary and necessary business expenses on the Schedule C Profit or Loss From Business based on the assumption of course that you can properly substantiate the expenses if called upon to do so by a taxing agency.

The Ultimate List Of Tax Deductions For Online Sellers Business Tax Deductions Tax Deductions Small Business Tax Deductions

The Ultimate List Of Tax Deductions For Online Sellers Business Tax Deductions Tax Deductions Small Business Tax Deductions

Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator.

How to deduct unreimbursed business expenses in 2020. If you incurred vehicle expenses for more than one vehicle complete a separate Part 2 of Schedule M1UE for each vehicle. However employees with impairment-related work expenses on Form 2106 report these expenses on Schedule A Form 1040. The expense must be paid during the tax year you are filing.

Dont include any expenses you can deduct as an itemized deduction. 1 day agoA 2020 COVID-19 relief bill made taxpayer-friendly changes. Jan 03 2021 Add up all your itemized deductions on the schedule and enter the total on line 12 of your 2020 Form 1040 in place of the standard deduction youd otherwise be entitled to.

And it still covers applicable entertainment expenses. 20 hours agoYour unreimbursed medical and dental expenses including premiums deductibles copayments and other Medicare expenses may be deductible to the extent that they exceed 75 of your adjusted gross. Your business can deduct 100 of food beverage and entertainment expenses.

Oct 06 2020 The vast majority of W-2 workers cant deduct unreimbursed employee expenses in 2020. If you are organized under another business form then the business may deduct the ordinary and necessary expenses of operating or conducting that business. 1 day ago The IRS released guidance in Notice 2021-25 to deal with the temporary allowance of a 100 deduction for restaurant business meal expenses under IRC 274n2D that was added to the law in December of 2020 by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 TCDTRA.

Review the instructions beginning on Page 25 of the PA-40IN to determine if you can deduct expenses from your PA-taxable compensation. Where the home office deduction gets murky is for self-employed workers who had an office location pre-pandemic but have been working from home since the outbreak began. These expenses are not subject to the 2 percent limit that applies to most other employee business expenses.

Part 1Enter Your Expenses. If both spouses are eligible and file a joint return they can deduct up to 500 but not more than 250 each. Form 4562 to claim depreciation including the special allowance on assets placed in service in 2020 to claim amortization that began in 2020 to make an election under section 179 to expense certain property or to report information on listed property.

You can claim a deduction for an unreimbursed employee business expense by filing a PA Schedule UE Allowable Employee Business Expenses form along with your PA-40 Personal Income Tax Return. Qualified educators can deduct up to 250 of unreimbursed business expenses. Most of the categories of employees who are able to claim deductions for unreimbursed employees report these deductions as an adjustment to income on Schedule 1 Form 1040 discussed next.

Mar 12 2021 This deduction is limited to the regular federal per diem rate for lodging meals and incidental expenses and the standard mileage rate for car expenses plus any parking fees ferry fees and tolls. Claim these expenses on Form 2106 Employee Business Expenses and report them on Form 1040 or Form 1040-SR as an adjustment to income. The original office location may still be considered the primary place of business.

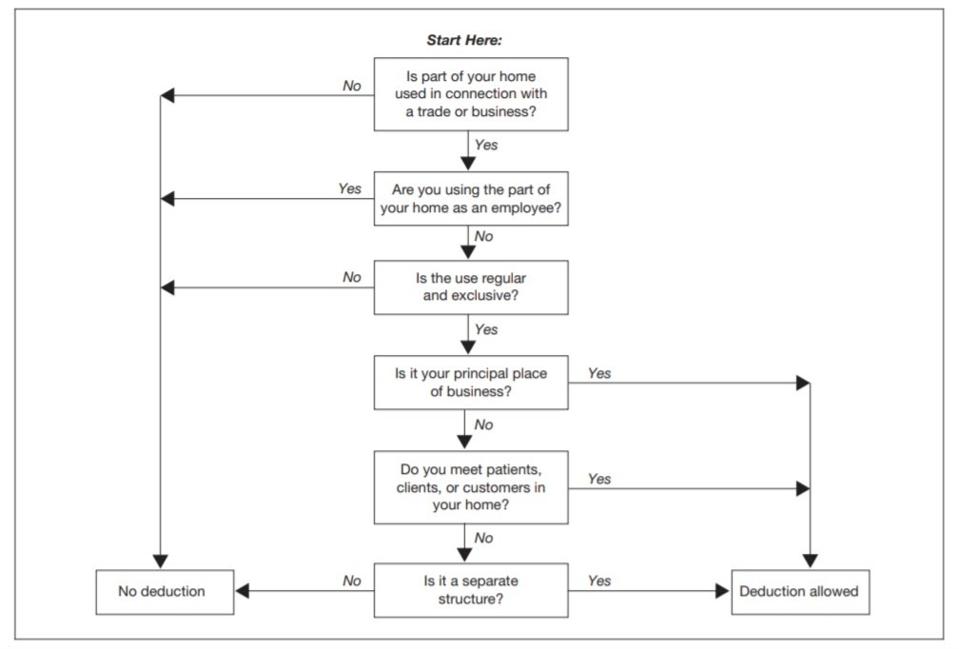

Jan 15 2019 You can deduct unreimbursed partnership expenses UPE if you were required to pay partnership expenses personally under the partnership agreement. Dont combine these expenses with or net them against any other amounts from the partnership. Oct 19 2020 If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return.

Jan 08 2021 There are three criteria that must be true in order to deduct unreimbursed employee expenses. Jan 25 2021 If these expenses are deductible they are deducted directly on Schedule E with the notation UPE and offset the distributive share of income which is also reported on Schedule E. You determine the percentage of your homes floor space that you use for business and apply that percentage to eligible deductible expenses.

For an expense to be ordinary it must be accepted in your job. IRS Tax Tip 2020-155 November 16 2020 Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Different lines will apply if youre filing your 2017 return.

The Tax Cut and Jobs Act TCJA eliminated unreimbursed employee expense deductions for all but a handful of. The short answer is. From line 20 or 28 on line 1.

It must be directly related to your job and it should be common and necessary to your line of work. For these unreimbursed expenses to be deductible the partnership or operating agreement or firm policy cannot provide for reimbursement See TC. Temporary Full Deduction Relief.

Feb 19 2021 Regular method.

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Eligibility To Claim Rebate Under Section 87a Fy 2019 20 Ay 2020 21 Illustrations In 2021 Business Tax Deductions Tax Deductions Business Tax

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Mileage Reimbursement Form Template Mileage Log Printable Mileage Printable Mileage

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Sheet Tax Write Offs Small Business Tax Business Tax Business Tax Deductions

Small Business Tax Prep Kit Tax Forms Tax Logs Tax Cheat Sheet Tax Write Offs Small Business Tax Business Tax Business Tax Deductions

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Why Tax Deductions Are So Important For Your Business In 2020 Business Finance Tax Deductions Small Business Finance

Why Tax Deductions Are So Important For Your Business In 2020 Business Finance Tax Deductions Small Business Finance

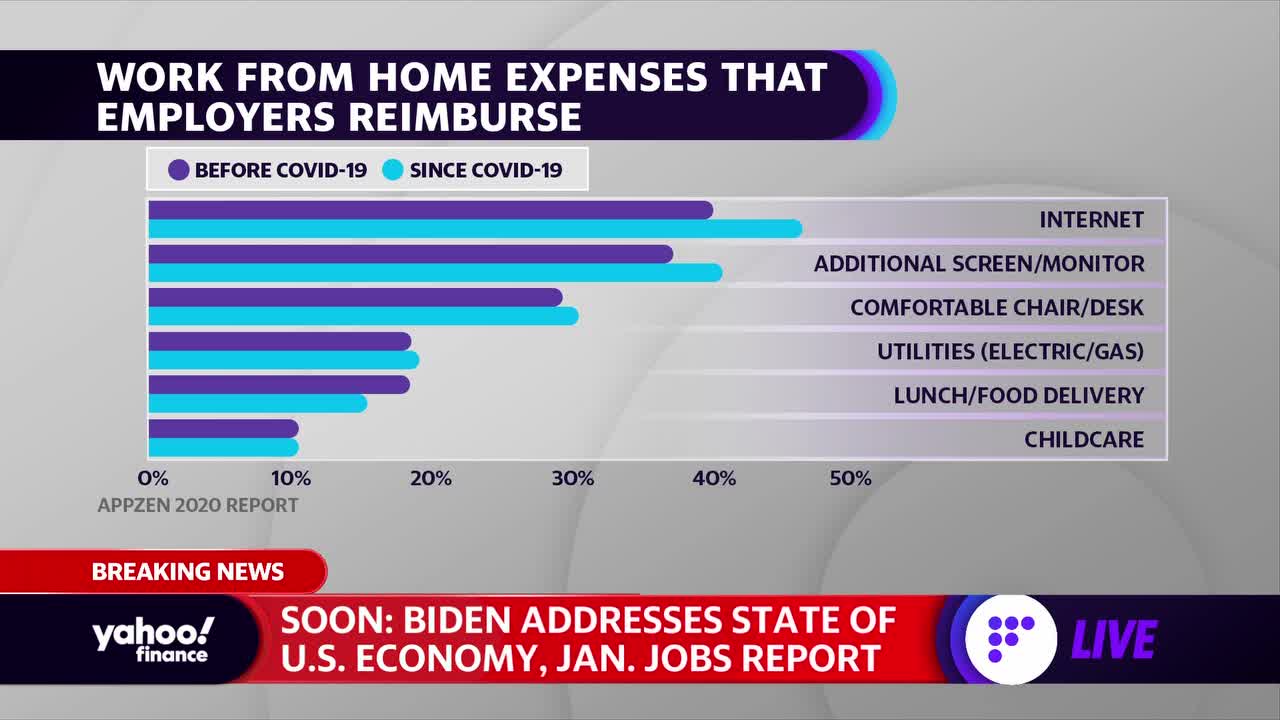

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

Elusive Employee Business Expense Tax Deduction In 2020 Tax Deductions Business Expense Deduction

Elusive Employee Business Expense Tax Deduction In 2020 Tax Deductions Business Expense Deduction

What To Bring To The Tax Appointment Appointment Bring Kitchenorganizationtips Organizationtipsforbedroom O In 2020 Tax Appointment Business Tax Tax Organization

What To Bring To The Tax Appointment Appointment Bring Kitchenorganizationtips Organizationtipsforbedroom O In 2020 Tax Appointment Business Tax Tax Organization

Pin On Gift Ideas Guides Diy Crafts Group Board

Pin On Gift Ideas Guides Diy Crafts Group Board

I Pinimg Com 736x E1 A3 B2 E1a3b2ce4167cb90799a

I Pinimg Com 736x E1 A3 B2 E1a3b2ce4167cb90799a

2020 Tax Information Standard Deduction Standard Deduction Irs Tax

2020 Tax Information Standard Deduction Standard Deduction Irs Tax

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Free Business Expense Spreadsheet Business Tax Deductions Small Business Tax Small Business Tax Deductions

Free Business Expense Spreadsheet Business Tax Deductions Small Business Tax Small Business Tax Deductions

5 Simple Items To Consider For Your Small Business Expense Checkup Tax Queen Small Business Expenses Small Business Tax Business Expense

5 Simple Items To Consider For Your Small Business Expense Checkup Tax Queen Small Business Expenses Small Business Tax Business Expense

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service

Instructions For Form 8995 2019 Internal Revenue Service Workbook Federal Income Tax Internal Revenue Service