How Does 1099-r Affect Taxes

The taxation of funds reported on your 1099-R depends upon the type of distribution youve received. Ill choose what I work on - if that screen comes up Retirement Plans Social Security IRA 401 k Pension Plan Withdrawals 1099-R.

1099 R Income From Deceased Spouse 1099r

1099 R Income From Deceased Spouse 1099r

Do not also send in federal Form 1099-R.

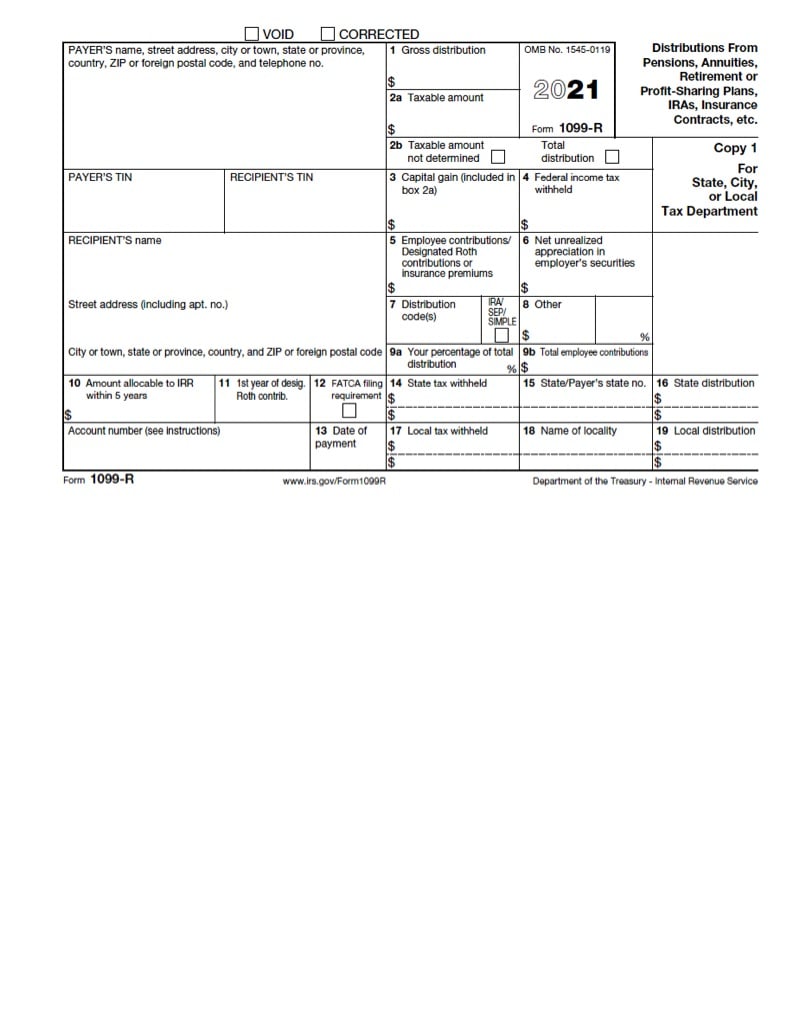

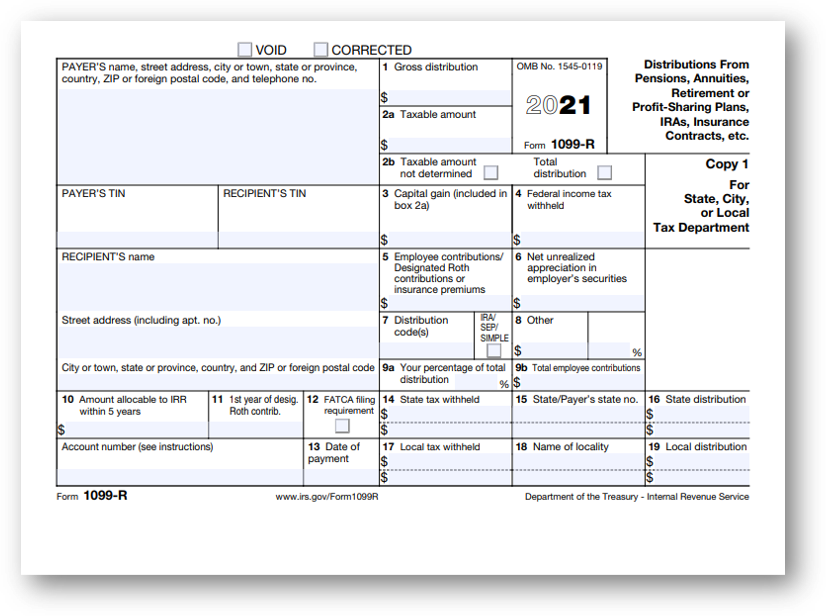

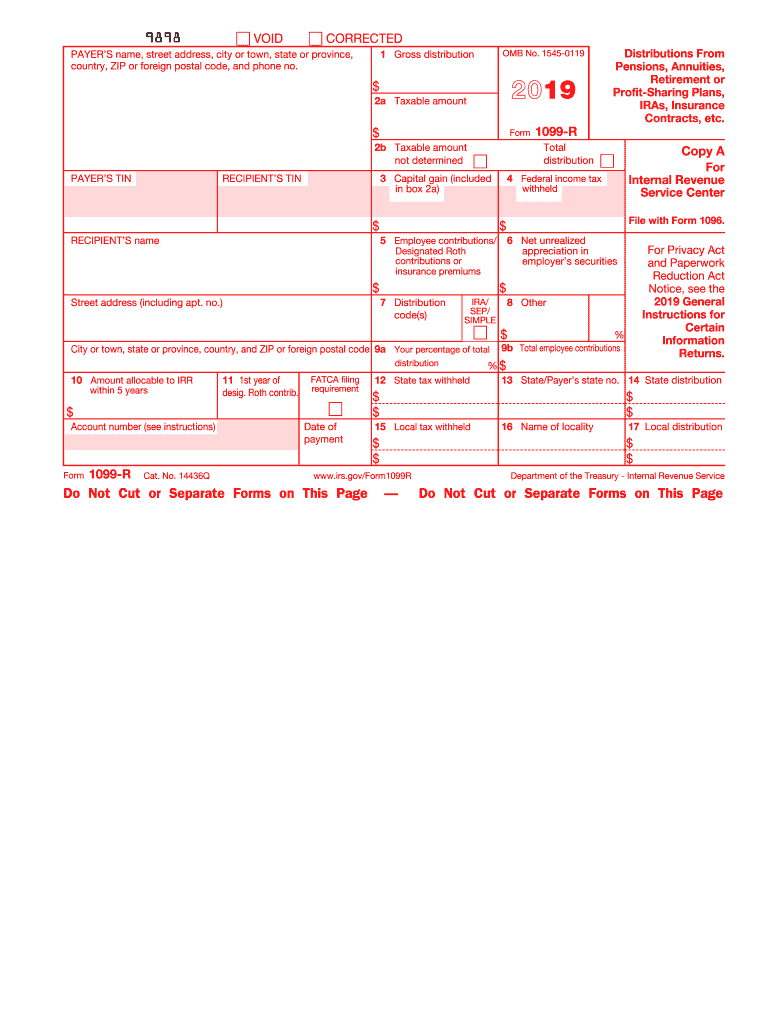

How does 1099-r affect taxes. If you do report the distribution of DVECs in boxes 1. General distributions from traditional 401 k plans including normal distributions hardship withdrawals and excess deferral returns are taxable. A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts many of which are retirement savings accounts.

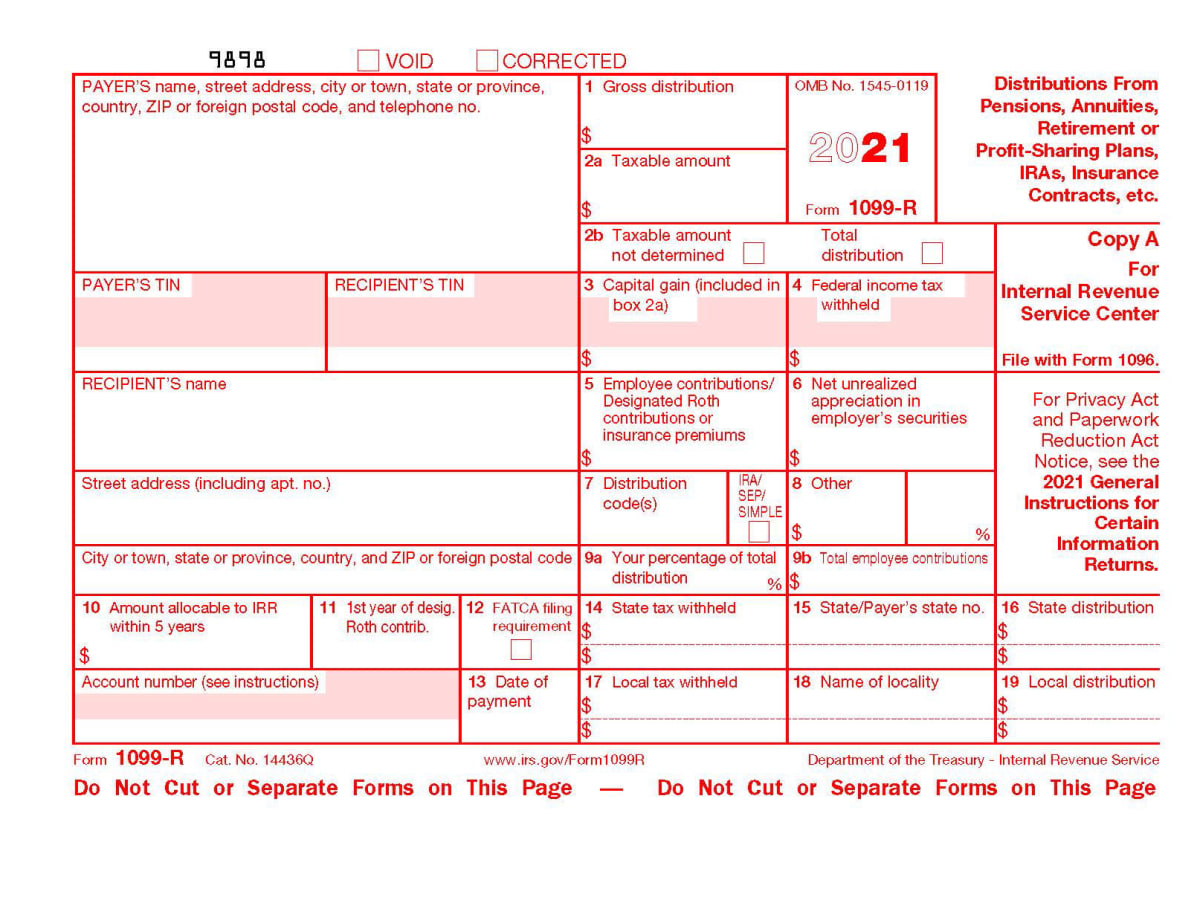

However distributions from Roth accounts generally are not. The plan or account custodian completing the 1099-R must fill out three copies of every 1099-R they issue. Form 1099-R is issued when a taxpayer does not make the required loan payments on time.

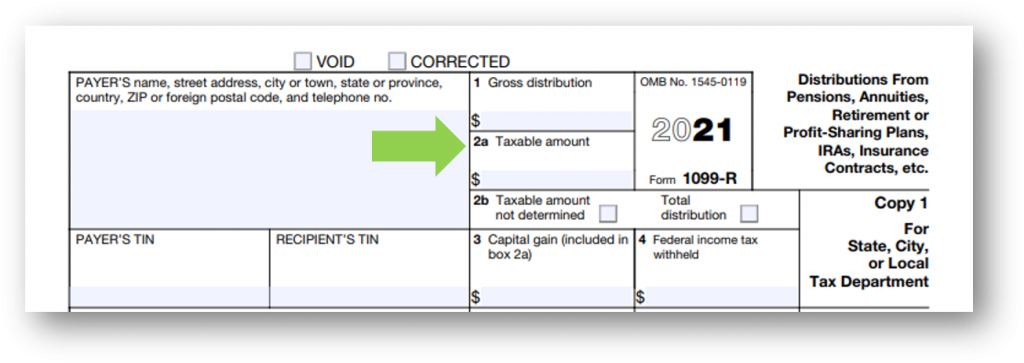

Keep it for your records. These show payment due to death of the account owner. Box 1 - This shows the distribution amount you received during the tax year.

Especially when you see the information in the form saying that the information has been forwarded to the IRS. Since the earned income credit is limited to individuals who have an adjusted gross income under a certain amount unearned income from a Form 1099-R may affect eligibility for the earned income credit EIC. File the form with your taxes.

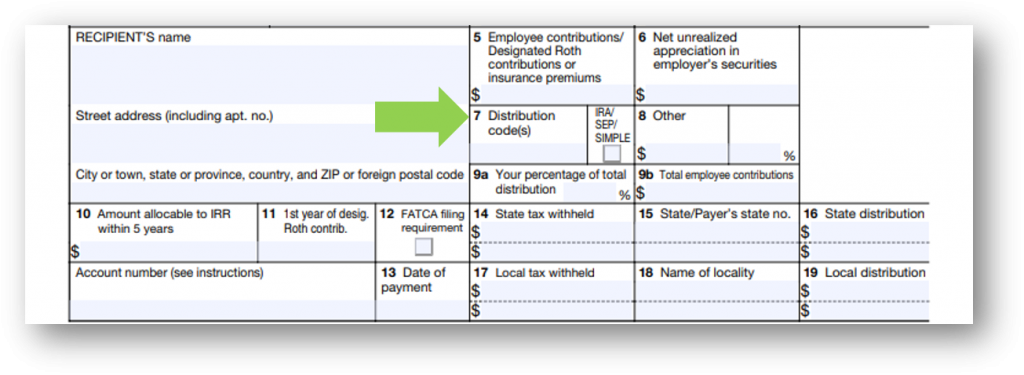

Regarding 1099-R distribution codes retirement account distributions on Form 1099-R Box 7 Code 4 are still taxable based on the amounts in Box 2a. IRA trustees required to report any events involving withdrawals of. You do not get money back for a 1099-R.

Federal withholding on the 1099R if nothing this will reduce your refund andor increase your tax Various credits could be affected some positively and others negatively - this depends on the total overall income. No beginning with tax year 2015 if the 1099-R shows NYS NYC or Yonkers tax withheld you must copy the required information from federal Form 1099-R onto the New York State Form IT-1099-R Summary of Federal Form 1099-R Statements and submit it with your return. IRS 1099 requirements say that you must be sent the form if someone paid you a distribution of 10 or more from such an account.

Federal Taxes Wages Income. Annuities pensions insurance contracts survivor. File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from.

The income on a Form 1099-R may be subject to federal income tax depending on the type of transaction. These distributions are deemed taxable income and may be subject to early distribution penalties. If the creditor does not send you a corrected Form 1099-C and you still disagree with the information you need to send a letter and supporting papers along with your tax return when you file it.

Unearned income and earned income. The IRS considers two types of income to make up a taxpayers gross income. Form 1099-R is generally used to report income that you received from a retirement account.

It also shows how much federal tax has already been withheld and what if anything you contributed toward a Roth individual retirement account or insurance premiums. One copy of each 1099-R goes to the IRS another to the taxpayer. This may delay processing of your return.

OR Use the Tools menu if online version left side and then Search Topics for 1099-R which will take you to. The amount that this added to your income could put you into another tax bracket. Enter a 1099-R here.

One for the IRS. If box 2a is zero you do not pay tax on it. Taxpayers must report all distributions of retirement or other income on the 1099-R on their IRS Form 1040 tax return.

The 1099-R tax form shows the gross amount of passive income paid to you during the previous calendar year as well as what portion of it is taxable. Individuals who meet the conditions set forth by the IRS are required to file a federal income tax return even if they do not owe any federal income taxes. Youll generally receive one for distributions of 10 or more.

Deductible Voluntary Employee Contributions DVECs If you are reporting a total distribution from a plan that includes a distribution of DVECs you may file a separate Form 1099-R to report the distribution of DVECs. When this occurs the amount not repaid is considered a distribution and is usually reported on Form 1099-R with the distribution code L. Any individual retirement arrangements IRAs.

It must be included in the return regardless so you could enter everything else and write down the. This income could have been from a pension an annuity a retirement or profit-sharing plan an IRA or an insurance contract. When a Form 1099 R arrives in the mail for an IRA rollover which supposed to be tax-free you probably get nervous.

If you get money from a retirement plan IRA annuity or a similar arrangement you will likely receive a tax form called a 1099-R. However the 10 penalty on early distributions isnt applied as an exception for Code 4 distributions. Profit-sharing or retirement plans.

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

Irs 1099 R 2019 Fill And Sign Printable Template Online Us Legal Forms

Irs 1099 R 2019 Fill And Sign Printable Template Online Us Legal Forms

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

1099 R Says You Owe Tax What Happened To Your 2020 Ira Rmd Rollover

1099 R Says You Owe Tax What Happened To Your 2020 Ira Rmd Rollover

Irs Form 1099 R What Every Retirement Saver Should Know Nasdaq

Irs Form 1099 R What Every Retirement Saver Should Know Nasdaq

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company

1099 R Qualified Charitable Distribution Qcd 1099r

1099 R Qualified Charitable Distribution Qcd 1099r

Opers Tax Guide For Benefit Recipients

Opers Tax Guide For Benefit Recipients

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

1099 R Form Mers Municipal Employees Retirement System Of Michigan

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Early 2019 Important Retiree Tax Reminders Teachers Retirement System Of The State Of Illinois

Tax Form Focus Irs Form 1099 R Strata Trust Company

Tax Form Focus Irs Form 1099 R Strata Trust Company