Where Do I Find My 1099-div

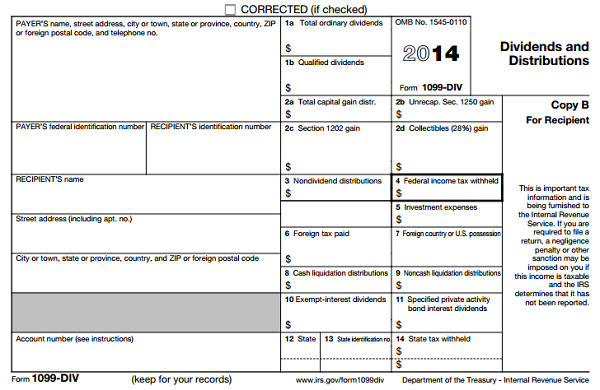

Information about Form 1099-DIV Dividends and Distributions Info Copy Only including recent updates related forms and instructions on how to file. The 1099-DIV is a common type of IRS Form 1099 which is a record that an entity or person not your employer gave or paid you money.

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Irs Approved 1099 R Tax Forms You File This Form For Each Person To Whom You Have Made A Designated Distribution Or Are Disability Payments Tax Forms Annuity

Youll find your forms in your personal tax center as soon as theyre available.

Where do i find my 1099-div. To print or view your 1099-MISC income tax statement visit myPFD. Distributions from partnership securities. TurboTax update R21 March 14 to fixed this issue on my return.

To obtain this dividend information or a duplicate Form 1099-DIV you may contact Computershare see contact information. Enter any qualified dividends from box 1b on Form 1099-DIV on line 3a of Form 1040 Form 1040-SR or Form 1040-NR. For more information see.

UNDERSTANDING YOUR 1099-DIV If you received dividends on stock or other securities you also received IRS Form 1099-DIV which provides information you need to file your taxes. You can view your last statements of the year to determine if you have earned 1000 or more in interest dividends or distributions from retirement accounts. Get them as soon as theyre available Remember that tax forms are always posted online as soon as theyre.

Nonresident Alien Income Tax Return. Click the button I earned interest exempt dividends in more than one state and then in the first State box use the drop down to select Multiple States and put the entire amount from box 11 in the box next to that selection. You can also access your tax forms digitally.

All 1099-DIV and 1099-B forms are mailed out by mid-February at the latest. Employee plan participants can find them in the Tax Forms and Documents section of. You may not receive a 1099 form in the amount is less than 1000.

Computershare makes gathering your tax information and filing a little easier. Simply log on to your account and. An IRS Form 1099-DIV is only issued for an account when the dividends paid on Publix stock are 10 or more for the tax year.

I am missing my 1099-INT 1099-DIV or 1099-R. Where can I look to determine if I will be receiving one this year. You can also find your investment income and distributions on your year-end statement.

Gross proceeds When shares are sold from the Computershare Investment Plan the IBM Employees Stock Purchase Plan or a payment on shares is issued as a result of shares tendered or a similar transaction Computershare must report the gross proceeds and taxes wihheld. The 1099-Div Worksheet now acts properly and doesnt ask for an entry for line d in box 6 if the box on line a is checked opting for deducting foreign taxes on Schedule A. Where can I find the state listed for 1099-DIV andor 1099-INT.

In some cases you will not receive a 1099-INT 1099-DIV or a 1099-OID but you still have interest or dividends that need to be reported on your tax return. Box 1b reports the portion of box 1a that is considered to be qualified dividends. Banks investment companies and other financial institutions are required to provide taxpayers with a 1099-DIV by Jan.

If you received dividends for shares held in a Publix stock account or PROFIT Plan account during the tax year access your IRS Form 1099-DIV online by registering for a Publix Stockholder Online account. If your mutual fund investment makes a capital gain distribution to you it will be reported in box 2a. Mail completed Forms 1099-DIV for Vanguard Real Estate Index Fund Admiral Shares.

Individual Income Tax Return Form 1040-SR US. While the K-1 form itself accounts for distributions or other items being passed through to the partners proceeds from the sale of partnership units are reported on the 1099-B section of your consolidated 1099. If you are not sure if you have interest or dividends to report contact your bank or financial institution and check on the account statements that you have received.

Your partnership administrator should mail your K-1 by April 15. Say Thanks by clicking the thumb icon in a post. Enter the ordinary dividends from box 1a on Form 1099-DIV Dividends and Distributions on line 3b of Form 1040 US.

Tax Return for Seniors or Form 1040-NR US. Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. Companies provide a copy of the Form 1099-DIV to the investor.

Depending on the amount of the dividend your childs dividend may be taxable. Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Reporting your 2020 Dividend of 992 for Federal Tax Purposes Dividends for Adults are taxable for federal income tax purposes.

Most of the forms Computershare issues only contain information in boxes 1a 1b 4 and the boxes titled Company Paid Fees and Discount on Reinvestment. You might receive a 1099-DIV tax form from your brokerage.

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 K 1099 Online 1099 K 1099 Misc In 2020 Online Tax Forms Irs

1099 K 1099 Online 1099 K 1099 Misc In 2020 Online Tax Forms Irs

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

2015 W2 Fillable Form Fillable Form Ir 25 City In E Tax Return For Fillable Forms Power Of Attorney Form 1099 Tax Form

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Email Signature Templates

1099 Form Fillable What Is A 1099 Form And How Do I File E What Is A 1099 Business Letter Template Email Signature Templates

Irs Approved 1099 B Tax Forms A Broker Is Any Person Who In The Ordinary Course Of A Trade Or Business Stands Ready To Effect S Tax Forms Irs Tax Preparation

Irs Approved 1099 B Tax Forms A Broker Is Any Person Who In The Ordinary Course Of A Trade Or Business Stands Ready To Effect S Tax Forms Irs Tax Preparation

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Due Dates For Your W 2 1099 Other Tax Forms In 2018 And What To Do If They Re Missing Tax Forms Student Loan Interest Finance Saving

Irs Approved 1098 E Tax Forms File This Form If You Receive Student Loan Interest Of 600 Or More From An Individual During The Y Tax Forms 1099 Tax Form Form

Irs Approved 1098 E Tax Forms File This Form If You Receive Student Loan Interest Of 600 Or More From An Individual During The Y Tax Forms 1099 Tax Form Form