How To Set Up Sole Proprietorship In Illinois

The most common is the business name registration. Even though a sole proprietorship is often seen as an informal structure.

How To Establish A Sole Proprietorship In Minnesota Nolo Com History Essay Sole Proprietorship Education In Pakistan

How To Establish A Sole Proprietorship In Minnesota Nolo Com History Essay Sole Proprietorship Education In Pakistan

Register a Business Name.

How to set up sole proprietorship in illinois. You need to register for a motor fuel permit You already hold one or more other permits with the Department of Revenue Otherwise - Click on the One Stop Business Registration to register your business with multiple agencies including the Department of Financial Institutions and the Department of Workforce Development. Sole proprietors without employees usually dont need to acquire a. If you plan to name.

Decide if you will run your business under your legal name or under an assumed business name. Select a Business Entity. Open a Business Bank Account.

Sole Proprietorship and General Partnership. Apply for Business Licenses Permits. Choose a Business Name.

The sole proprietorship isnt a formal legal entity so there is nothing to apply for or register. Solo entrepreneurs can minimize their potential liability and maximize their tax benefits by forming a single-member LLC SMLLC. There may also be additional steps needed depending on the state.

Write a Business Plan. File an Assumed Business Name. A Guide to Setting Up Your Business.

9 rows A sole proprietor is someone who owns an unincorporated business by. Choose a Business Idea. There is no government filing or approval required to operate your business as a sole proprietor.

To establish a sole proprietorship in Illinois heres everything you need to know. How to Become an Illinois Sole Proprietor DBA Acquisition. By Jane Haskins Esq.

File an assumed business name certificate with. If youre the sole owner of your business you dont have to operate as a sole proprietor. Starting a Business in Illinois Simple Step-by-Step Guide.

Learn more about the advantages of a single-member LLC and how to set one up. If you are the only owner of the business you are a sole proprietor. 2021 4 min read.

All thats required is that when you file your tax return using IRS form 1040 you file a separate sheet called the schedule C. Just report the profits and losses from the business in your tax return on IRS Form 1040 on a separate sheet called Schedule C. In Illinois a sole proprietor may use his or her own given name or may use an assumed.

In Illinois as in other states you do not have to register your sole proprietorship with the state. Create a plan for your Illinois business. When a business name is different from the owner s full legal name s the Illinois Assumed Name Act requires sole proprietorships and general partnerships to register with their local county clerks office for registration under the Assumed Name Act.

Getting certified reflects that. Its important to note that by default a single-owner business is automatically considered a sole proprietorship by the IRS. A doing business as DBA name is a crucial part of many sole proprietorships as it enables you to use.

Schedule C reports the profits and losses from the business. With sole proprietorships theres no need to file paperwork with the government. If you use a business name that is different from your legal.

However you are required to register an assumed business name if you use one and depending on the nature of your business you may also be required to obtain other permits and licenses. Millions of Americans do it this way. No approval is needed to run your business as an Illinois sole proprietor.

Think of general partnerships like sole proprietorships for teams the process of starting one is just as simple and inexpensive and profits from a partnership flow through to the partners personal income tax returns like they do for a sole proprietor.

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

How To Set Up A Sole Proprietorship In Illinois 8 Steps

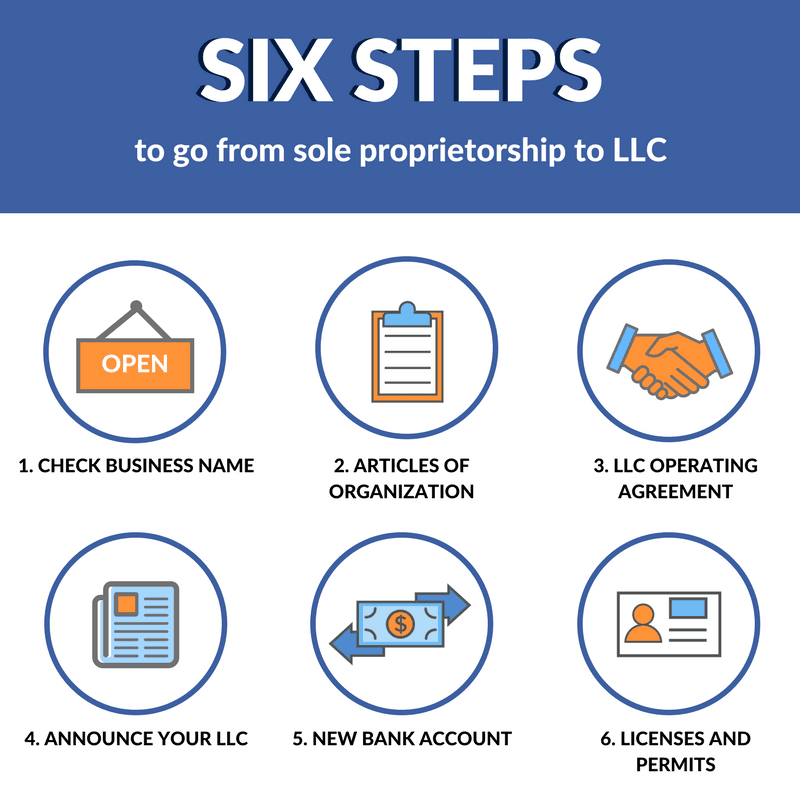

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Best 5 Hints For Small Business Success Small Business Success Success Business Small Business Coaching

Best 5 Hints For Small Business Success Small Business Success Success Business Small Business Coaching

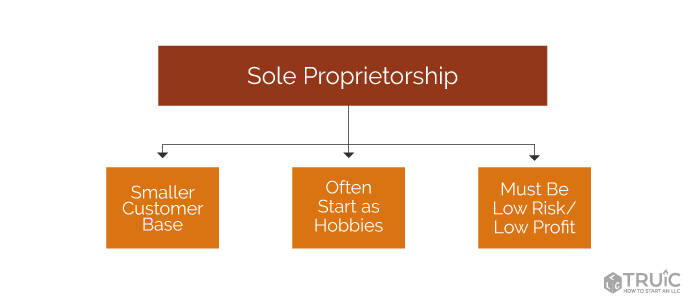

What Is A Sole Proprietorship A Truic Small Business Guide

What Is A Sole Proprietorship A Truic Small Business Guide

-(1).jpg?sfvrsn=0) Single Member Llc Vs Sole Proprietorship Bizfilings

Single Member Llc Vs Sole Proprietorship Bizfilings

Putting A Sole Proprietorship On Paper Legalzoom Com

Putting A Sole Proprietorship On Paper Legalzoom Com

Starting A Sole Proprietorship In San Mateo County Sole Proprietorship San Mateo County San Mateo

Starting A Sole Proprietorship In San Mateo County Sole Proprietorship San Mateo County San Mateo

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

5 Super Slick Tips For Your Sole Proprietorship Small Business Coaching Sole Proprietorship Business Books

Sole Proprietorship Laws In Illinois Legalzoom Com

Sole Proprietorship Laws In Illinois Legalzoom Com

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

Register Illinois Fictitious Business Name Illinois Trade Name Illinois Dba Business Format Sole Proprietor Illinois

A Corporation Is More Credible Than A Sole Proprietorship Or Partnership Incorporated Business Starting A Business Sole Proprietorship

A Corporation Is More Credible Than A Sole Proprietorship Or Partnership Incorporated Business Starting A Business Sole Proprietorship

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

Illinois Plumbers Sole Proprietor Surety Bond Bond Plumbing Contractor Illinois

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

5 Super Slick Tips For Your Sole Proprietorship Sole Proprietorship Small Business Coaching Business Books

When Does A Sole Proprietor Need An Ein How To Start An Llc

When Does A Sole Proprietor Need An Ein How To Start An Llc