Business Travel Reimbursement Taxable

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. To report the income.

You Are Soley Responsible For Your Own Tax Return According To The Irs Are You Certain You Are Pickin Bookkeeping Software Real Estate Tips Tax Preparation

You Are Soley Responsible For Your Own Tax Return According To The Irs Are You Certain You Are Pickin Bookkeeping Software Real Estate Tips Tax Preparation

Since SARS estimates that 80 of the travel allowance is taxable there is a view that in theory the estimated business could be seen to make up 20 of the actual allowance.

Business travel reimbursement taxable. If your business uses an accountable plan reimbursements are not taxable. To have an accountable plan your employees must meet all three of the following rules. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

There are different expense reimbursement rules for independent contractors who are paid via Form 1099. This means you will not have to include them in your end-of-year reports. The reimbursement is for expenses incurred for company purposes.

In other words if the estimated business travel is R2 000 per month the employee could be entitled to a maximum travel allowance of R10 000 per month. Otherwise you might improperly pay more taxes. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations.

However you can use any work-related expenses that one paid reimbursed or not as. Page 15 of IRS_ Publication 15 Circular E Employers Tax Guide_ states that expense reimbursements do not have to be included in an employees wages if the business has an accountable plan. This law came into effect in 2018 when moving expenses were no longer eligible as a.

Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period. You cant deduct expenses that are lavish or extravagant or that are for personal purposes. Some business travel expenses are covered by exemptions which have replaced dispensations.

Deducting the business expenses on your tax return is not the same as getting a tax credit. Finally if a payment falls outside your accountable plan that payment is considered a taxable benefit. An employer reimburses an employee for the hotel and travel expenses of the employees spouse when the spouse accompanied the employee on a business trip within Canada.

511 Business Travel Expenses. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. However the tax rules become more complex when the travel is of a longer duration.

Most businesses reimburse such expenses but are business expense reimbursements taxable income to the employee. You do not have to withhold or contribute income FICA or unemployment taxes. The employee must have incurred deductible expenses while performing services as your employee.

If a travel companion expenses are paid and the companion is not attending the meeting for a valid business reason the employee is subject to a taxable fringe benefit. Enter the 1099-Misc in the Other Common Income section Enter 1099misc in the Search Box and Select Jump to 1099misc. This reimbursement is in the nature of a salary or remuneration.

Unlike travel and other ordinary business expenses moving reimbursements do count as taxable income. They are taxable because employer reimbursements are paid through payroll. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes.

Most employers pay or reimburse their employees expenses when traveling for business. If you do not have an. The expense was documented in a reasonable amount of time with identifying information such as.

Most businesses prefer to include reimbursement amounts in the 1099 income rather than go through reimbursing expenses. The reimbursement is considered to be a taxable benefit for income tax purposes. Generally expenses for transportation meals lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip.

Payments to employees belong on form W-2 not Form 1099. If one is paid more than 600 in a year from a company that company should issue you and the IRS a Form 1099 which will include all payments to you including reimbursement. To prevent you from getting taxed on the reimbursement you will have to report the expenses that were reimbursed.

Make sure your employer completes your pay stub correctly to reimburse your travel expenses. An accountable plan is not taxable as long as it follows these specific guidelines.

.svg)

Tax Rules When Your Business Trip Involves A Passport Mueller

Tax Rules When Your Business Trip Involves A Passport Mueller

What You Need To Know About Publication 463 And Business Travel

What You Need To Know About Publication 463 And Business Travel

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Uber Car Mileage

Rideshare Deductions Standard Mileage Vs Actual Vehicle Expenses Rideshare Uber Car Mileage

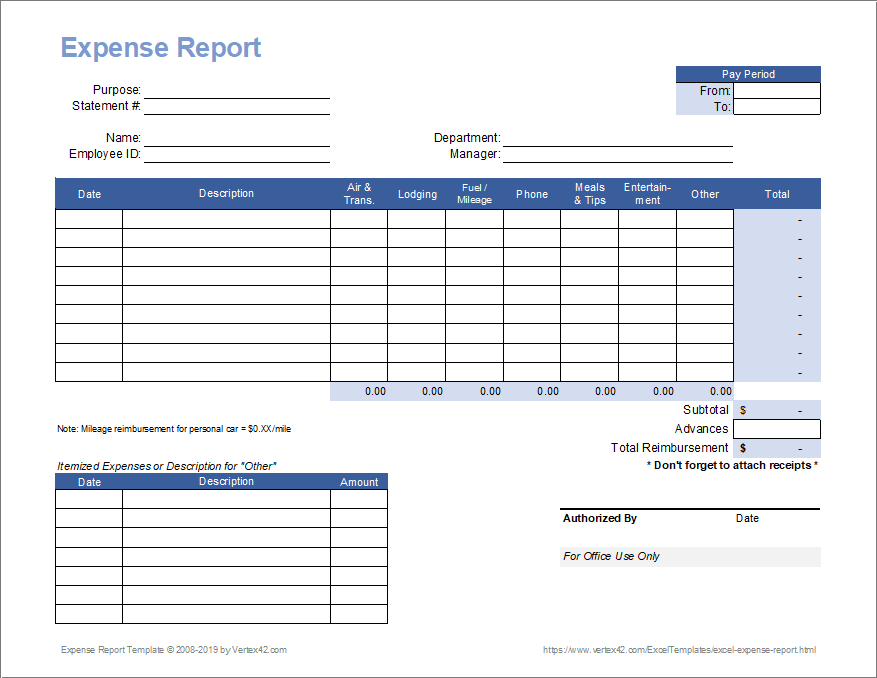

Business Travel Expense Report Template Expense Sheet Small Business Expenses Spreadsheet Template Business

Business Travel Expense Report Template Expense Sheet Small Business Expenses Spreadsheet Template Business

Expense Reimbursement Form Template Awesome Home Expense Form Sample Forms How To Memorize Things Templates Traveling By Yourself

Expense Reimbursement Form Template Awesome Home Expense Form Sample Forms How To Memorize Things Templates Traveling By Yourself

Expense Reimbursement Policy Best Practices And 3 Templates

Expense Reimbursement What Should You Pay For Teampay Teampay

Expense Reimbursement What Should You Pay For Teampay Teampay

Expense Reimbursement Policy Best Practices And 3 Templates

Travel Expense Reimbursement Form Template Unique Template Mileage Form Template How To Memorize Things Templates Traveling By Yourself

Travel Expense Reimbursement Form Template Unique Template Mileage Form Template How To Memorize Things Templates Traveling By Yourself

Free Expense Report Templates Smartsheet Intended For Small Business Expenses Spreadsh Excel Spreadsheets Templates Spreadsheet Template Balance Sheet Template

Free Expense Report Templates Smartsheet Intended For Small Business Expenses Spreadsh Excel Spreadsheets Templates Spreadsheet Template Balance Sheet Template

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

What Is Per Diem The Per Diem Allowance Is Paid By The Employer To Its Employees For Lodging Meals And Incidental Expenses Incurre Per Diem Irs Cost Of Goods

What Is Per Diem The Per Diem Allowance Is Paid By The Employer To Its Employees For Lodging Meals And Incidental Expenses Incurre Per Diem Irs Cost Of Goods

Taxes On Employee Expense Reimbursement Taxact Blog

Taxes On Employee Expense Reimbursement Taxact Blog

Filing Taxes For Small Businesses And Entrepreneurs Can Be Confusing Navigate How To File Taxes For Self Employed Indi The Penny Hoarder Filing Taxes Tax Time

Filing Taxes For Small Businesses And Entrepreneurs Can Be Confusing Navigate How To File Taxes For Self Employed Indi The Penny Hoarder Filing Taxes Tax Time

Manage Expense Reports And Reimbursements With Ease 247hrm Hrsoftware Solutions Medical Online

Manage Expense Reports And Reimbursements With Ease 247hrm Hrsoftware Solutions Medical Online

Expense Reimbursement Policy Best Practices And 3 Templates